Federal Credit Union: Trustworthy and Safe Banking in Wyoming

Federal Credit Union: Trustworthy and Safe Banking in Wyoming

Blog Article

Unleash the Power of Lending Institution for Your Finances

From exclusive advantages to a much more individualized method, credit history unions provide an unique economic landscape that can raise your monetary standing. Check out how credit report unions can reinvent the method you manage your financial resources and pave the path in the direction of an extra safe and secure economic future.

Benefits of Signing Up With a Credit Rating Union

Signing up with a credit scores union provides various advantages for individuals seeking economic security and community-oriented financial services. One crucial advantage is the tailored interest and tailored financial services credit unions offer to their members.

In addition, lending institution are known for their remarkable client service, with a strong emphasis on building long-term connections with their members. When managing their financial resources, this commitment to tailored solution implies that participants can expect a greater level of care and assistance. Furthermore, lending institution usually provide economic education programs and sources to aid members boost their financial proficiency and make notified choices about their money.

Saving Cash With Lending Institution

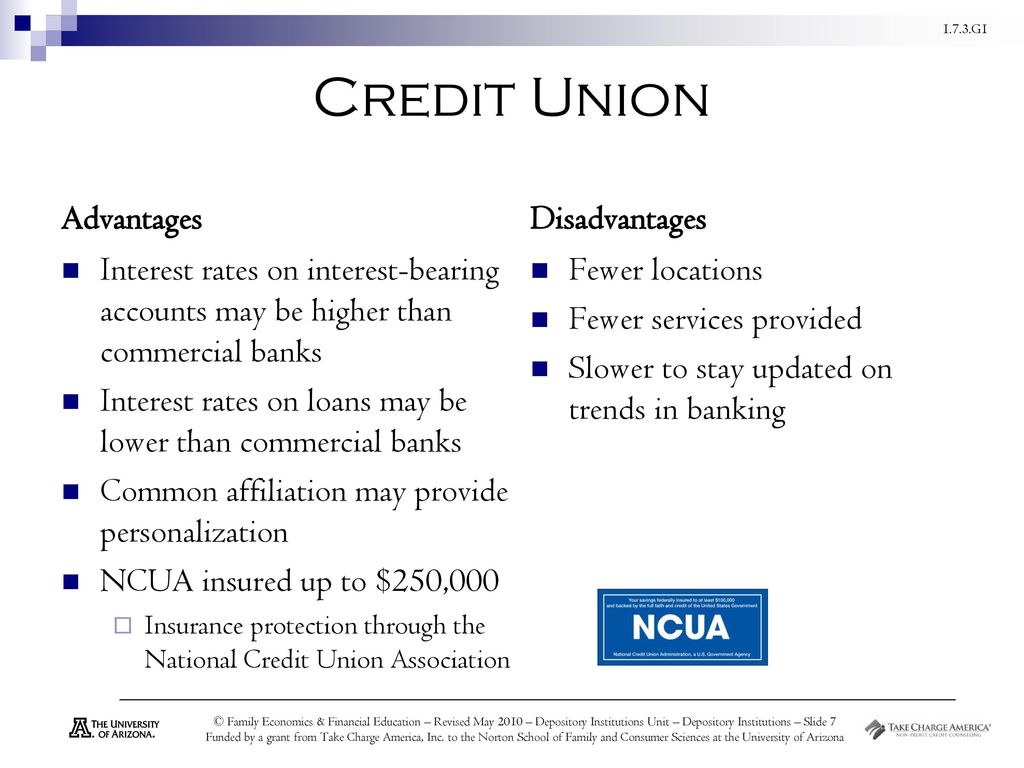

Lending institution offer cost-effective economic solutions that can aid individuals save money and achieve their financial goals. One of the primary methods lending institution assist members in saving money is through higher rate of interest on cost savings accounts contrasted to standard financial institutions. By earning more on their deposits, members can see their savings expand much faster over time. Additionally, cooperative credit union usually have lower fees and account minimums, making it easier for participants to maintain even more of their hard-earned money.

An additional advantage of conserving cash with lending institution is the customized service they give. Unlike large financial institutions, cooperative credit union are member-owned and focus on the well-being of their participants. This means they are more inclined to offer customized recommendations and items to help people conserve successfully. Furthermore, credit report unions typically use financial education resources, such as workshops or online devices, to aid participants make educated choices and boost their conserving habits.

Loaning Wisely From Cooperative Credit Union

When thinking about economic choices, people can utilize the borrowing chances supplied by cooperative credit union to access inexpensive and tailored lending products. Lending institution are not-for-profit monetary institutions that prioritize their members' economic health, often offering reduced passion prices and costs contrasted to standard financial institutions. By obtaining intelligently from credit report unions, people can take advantage of tailored services and a more community-oriented method to financing.

One of the essential advantages of borrowing from credit report unions is the possibility for reduced rates of interest on car loans - Credit Unions in Wyoming. Credit history unions are understood for providing competitive rates on numerous sorts of loans, consisting of individual lendings, car lendings, and home mortgages. This can lead to significant cost savings over the life of the funding compared to obtaining from traditional financial institutions

Additionally, cooperative credit union are extra versatile in their lending requirements and might be much more happy to deal with participants who have less-than-perfect credit. This can give individuals have a peek at this website with the possibility to access the funds they need while additionally enhancing their credit history gradually. By borrowing wisely from lending institution, people can accomplish their financial objectives while developing a positive relationship with a relied on financial companion.

Planning for the Future With Credit Scores Unions

To safeguard a secure financial future, people can tactically straighten their long-term objectives with the comprehensive preparation services supplied by cooperative credit union. Lending institution are not just about fundings and financial savings; they also offer useful financial planning support to assist participants accomplish their future ambitions. When preparing for the future with cooperative credit union, members can take advantage of customized monetary advice, retirement planning, investment support, and estate preparation services.

One key advantage of using lending institution for future planning is the customized method they offer. Unlike traditional financial institutions, credit unions often take the time to understand their participants' special monetary circumstances and tailor their services to fulfill private needs. This customized touch can make a significant distinction in helping participants reach their long-lasting monetary goals.

In addition, cooperative credit union usually prioritize their members' monetary well-being over earnings, making them a trusted companion in preparing for the future. By leveraging the know-how of lending institution professionals, participants can create a strong financial roadmap view it that lines up with their aspirations and establishes them on a path towards long-lasting economic success.

Achieving Financial Success With Credit Unions

Leveraging the monetary proficiency and member-focused technique of credit scores unions can lead the method for people to achieve enduring financial success. Cooperative credit union, as not-for-profit financial cooperatives, focus on the financial wellness of their participants most of all else - Hybrid Line of Credit. By ending up being a participant of a cooperative credit union, individuals get to a series of monetary product or services tailored to satisfy their details needs

One crucial way credit history unions aid participants accomplish monetary success is via supplying competitive interest rates on cost savings accounts, financings, and credit history cards. These positive rates can cause considerable cost savings gradually contrasted to standard financial institutions. In addition, credit unions frequently have lower fees and even more personalized customer support, cultivating a helpful atmosphere for members to make sound financial decisions.

In addition, credit rating unions usually provide financial education sources and counseling to aid participants enhance their monetary literacy and make informed choices. By capitalizing on these services, individuals can develop strong finance skills and work towards achieving their long-term economic objectives. Inevitably, partnering with a lending institution can encourage people to take control of their funds and establish themselves up for a safe and secure financial future.

Conclusion

Finally, the power of lending institution depends on their capacity to provide customized attention, customized economic services, and member-owned cooperatives that prioritize area needs. By joining a cooperative credit union, individuals can take advantage of lower costs, competitive passion rates, and phenomenal client service, bring about conserving money, obtaining sensibly, preparing for the future, and attaining monetary success. Embracing the special benefits of cooperative credit union can assist individuals protect their financial future and boost their websites overall monetary health.

Credit scores unions are not-for-profit economic organizations that prioritize their members' economic wellness, often supplying lower passion rates and fees contrasted to conventional financial institutions.Additionally, credit rating unions are extra versatile in their borrowing requirements and might be a lot more willing to work with participants that have less-than-perfect credit scores.One vital method credit rating unions aid members attain financial success is through using competitive rate of interest prices on cost savings accounts, lendings, and debt cards.Additionally, credit scores unions typically use economic education resources and counseling to aid members boost their financial proficiency and make educated choices.

Report this page